THE MONACO MBA PROGRAM OVERVIEW

Opting to pursue an MBA is a significant decision in life. Selecting the right one is even more of a challenge. This choice can make a difference to one’s personal growth and professional success in their career ahead.

There are hundreds of business schools worldwide offering an MBA and dozens of excellent programs in Europe. So the question arises, how to choose?

Answers to this question should focus less on the school and more on the program’s objective. Hence, the real question is, «what do you want to achieve out of the MBA?». If the idea is to acquire the necessary business skills along with a diploma to prove it, then just about any accredited program will do.

However, if someone wants to challenge themselves in an intensive program and emerge enriched with new skills, perspectives, and contacts, then one should consider the Monaco MBA. Set in the unique international environment of the Principality of Monaco, the Monaco MBA program experience stands apart from all the others.

If you are looking to grow, personally and professionally, through an immersive and multicultural experience in a unique learning and networking environment, then the Monaco MBA is for you.

Dr. Marika TAISHOFF

MBA PROGRAM DIRECTOR

MBA Career Coach

Caroline Frisenberg

5 reasons, why should you follow the “MONACO MBA” at IUM

- One of the key advantages of our MBA program is that you learn from Monaco’s unique expertise in luxury services, wealth management, entrepreneurship, and innovation.

- The program has a 10-month full-time or 20-month part-time options for working professionals, and may be completed on-campus or remotely / distant.

- It is accredited by the Association of MBAs, which pledges to uphold standards and promote innovation in worldwide postgraduate management education.

- An all-year Career & Personal Development Coaching and Mentorship Program is desinged for our MBA cohort.

- The MBA program is ranked 50th among the best 100 MBA programs worldwide by The Economist’s Which MBA? (2022 ranking)

MBA Program Description

The Master of Business Administration program at IUM, also referred as the Monaco MBA, is a post-experience Master level program designed for applicants who already have management experience in their hands. It prepares individuals for high-level management careers by immersing them in a truly multicultural learning environment and emphasizing the practical applications of management theories and disciplines. Earning an MBA in Monaco will allow you to expand your professional network in Monaco, since 5000+ enterprises are located within walking distance of our campus.

Our MBA is designed as a unified program that fosters seamless learning experiences for all students, whether they are on-campus or connected remotely. Through synchronous learning, both in-person and online students attend the same classes simultaneously, ensuring an equitable educational experience that encourages interaction and collaboration among peers.

At the International University of Monaco, we believe in providing an inclusive environment where all students have equal access to high-quality education and opportunities for meaningful engagement with their professors and fellow classmates. Our distinguished faculty members, renowned experts in their respective fields, are committed to delivering engaging and interactive lessons that inspire critical thinking and foster a collaborative learning environment.

Course Schedule

Our program’s course schedule has been updated for the upcoming academic year 2024/2025 to better serve our students. Going forward, classes will be held exclusively in the afternoons, from 1:00 PM to 5:15 PM, Central European Time. Elective classes, special events and webinars might take place after classes’ schedule.

Who can apply to IUM’s MBA?

IUM’s MBA is aimed at professionals who want to give a new impetus to their careers or who want to progress to positions of greater managerial responsibility. There is no standard profile for MBA students and we welcome students coming from different countries and very diverse backgrounds.The only requirements to be eligible for application are to hold a Bachelor degree and at least 3 years of professional experience.

Learning Goals and Objectives

After completing the Monaco MBA, graduates will:

- BE ANALYTICAL THINKERS AND INNOVATIVE PROBLEM SOLVERS: Critically analyze complex business situations to develop proper strategies.

- BE EQUIPPED TO LEAD RESPONSIBLY IN A BUSINESS ORGANIZATION: a. Master critical business functions and management theories. b. Understand the processes to drive change and motivate people.

- BE EFFECTIVE DECISION MAKERS: Make business decisions considering the impact on different stakeholders.

- BE ARTICULATE AND INSPIRING COMMUNICATORS: Deliver well‐structured and compelling communications.

- BE COLLABORATIVE TEAM PLAYERS: Be able to work collaboratively in a multicultural group toward achieving shared objectives.

What separates a full-time MBA from a part-time MBA

You can choose to take IUM’s MBA full-time or part-time. In the first case, the course is given face-to-face on the Monaco campus and lasts for 10 months. In the part-time option, the course lasts 20 months. Students who choose the part-time option can keep on working while studying.

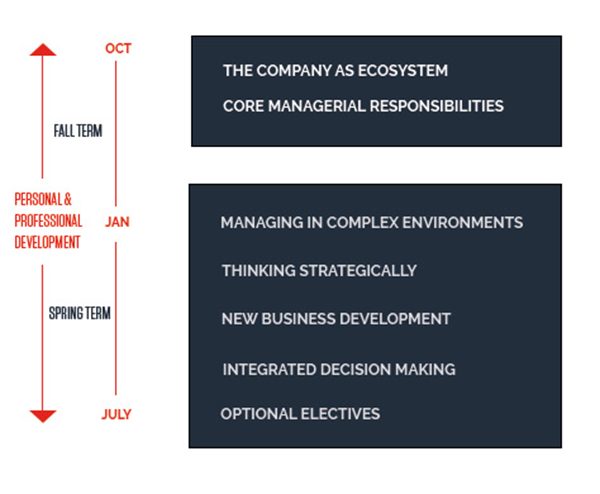

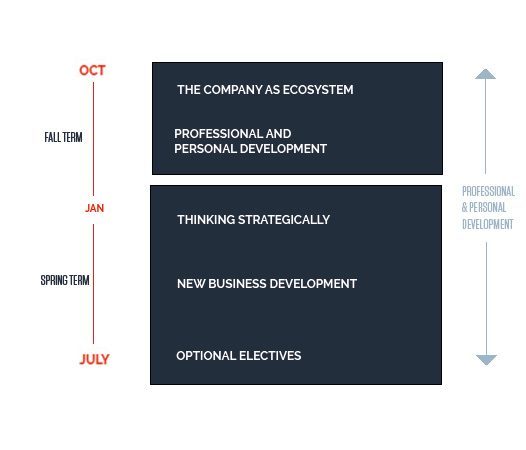

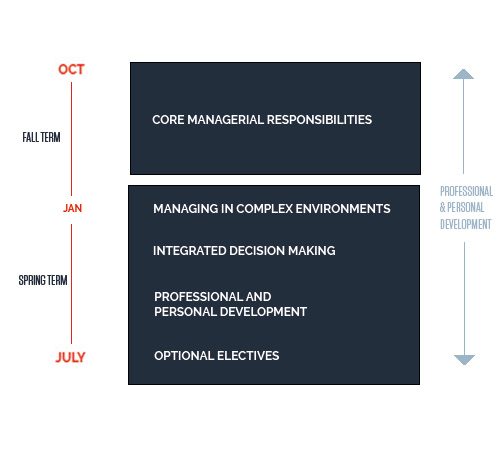

MBA FULL-TIME 10 months

MBA PART-TIME 20 months

YEAR 1

YEAR 2

In which language is the program taught?

What level of English is required to enter that course?

IUM’s MBA is taught entirely in English. One of the following scores is required in English in order to apply to this course:

- IELTS 6.5 (CECR C1 level)

- TOEFL: 83

- Cambridge: CAE

If the candidate is a native speaker or has worked in English, no test is required.

MBA Voices – Tariq Khoso

Financial Controller at VeUP Ltd.

AMBA REACCREDITATION FOR 5 YEARS FOR OUR MBA PROGRAM

Thanks to the ever-present enthusiasm and engagement of students, faculty, and staff, our entire IUM community is delighted to announce the AMBA reaccreditation for five years for our MBA program.

Throughout 2023 IUM will continue to embrace diversity and support our students as they, in their own unique ways, innovate, create real change, and have an impact in the University, and in the community at large.

THE MONACO MBA PROGRAM FREQUENTLY ASKED QUESTIONS

Do I need to put my job on hold to do the MBA?

The MBA is offered in two formats: the full-time option, which takes ten months and is entirely taught on campus in Monaco. The part-time format is aimed at professionals who want to continue working and follow online or on-campus courses when their timetable allows. Therefore, it’s feasible to work full-time and follow the MBA part-time.

What are the criteria to apply for the MBA program?

You need to have a minimum of a Bachelor’s degree and at least three years of professional experience. IUM is particularly interested in your motivation and career objectives. That’s why candidates from diverse backgrounds such as engineering, medical field, sciences, and liberal arts find themselves in the Monaco MBA.

Is an internship part of the MBA program?

No, it isn’t. You’ll undertake a consultancy project within a company to present viable solutions for a real issue that a company encounters. You’ll be fully part of this company for the period of your consultancy project, and IUM MBA students are highly valued and appreciated by company directors and staff.

Have Questions About the Monaco MBA Program?

Schedule a personal consultation call with our Recruitment team and solve all your questions!

MBA program in Brief

A STRONG EMPHASIS ON EXPERIENTIAL LEARNING

The experiential learning approach characterizes the entire curriculum, emphasizing applications, real world examples, and case studies throughout the year. This approach The experiential learning approach characterizes the entire curriculum, emphasizing applications, real-world examples, and case studies throughout the year. This approach culminates in the integrative components at the end of the program: the Corporate Consulting Project or the Entrepreneurial Business Plan, and the Business Simulation. The Projects, which constitute the capstone of the MBA curriculum, offer students the opportunity to work on concrete, topical challenges given to them by companies and to be actively involved with relevant company executives in strategic decision-making and recommendations.

THE MONACO MBA INSIGHTS

Jennifer Crentsil

It has been an incredible journey, which has equipped me with a strong foundation in business strategy, leadership, finance and marketing. The MBA program has not only broadened my understanding of the business world but has also sharpened my critical thinking and problem-solving skills.

Stella PANAGIOTIDOU

MBA 2023

PLACEMENT DATA

IUM Alumni are working in International Companies worldwide

Top Employers include:

AIRFRANCE TRANSAVIA, AMADEUS SAS, AMAZON, BLOOMBERG, BOTTEGA VENETA, CAMPARI, CAPGEMINI, CARREFOUR, CHANEL, CREDIT SUISSE, DELOITTE, ERNST & YOUNG, FIAT CHRYSLER AUTOMOBILES, HEINEKEN, J. SAFRASARASIN, NESTLÉ SKIN HEALTH, HERMES, IMMOFINANZ, JPMORGAN CHASE & CO., KERING, KPMG, LAVAZZA, MICROSOFT, MOORE STEPHENS, RICHEMONT, SBM OFFSHORE, SWAROVSKI, UBS.

Teaching IUM’s MBA is challenging and exciting: bridging theory and practice, and fostering collaborative learning are key pillars of our pedagogical approach; we assign group projects and activities in all courses, mixing deliberately residential and distant learning students; MBA graduates learn to switch seamlessly from classical to virtual teamwork activities in which they inspire their colleagues by leveraging trust, effective collaboration, motivation, autonomy and communication.

Dr. Alessio CASTELLO

Professor of Management

What career can you consider after completing IUM’s MBA?

IUM offers a generalist MBA. Group projects and in-company consultancy enable you to develop highly sought-after managerial skills. You can also become a consultant in your preferred sector and bring your expertise to a wide range of companies after completing the MBA. The program also provides all necessary tools and network to professionals willing to create their own business or to entrepreneurs who want to to develop their companies.

Admissions and Fees of the Monaco MBA Program

We strive to select a diverse student body, one that not only reflects a variety of backgrounds, cultures, and nationalities but a wide range of personal interests and professional ambitions. we seek applicants with high potential from all over the world who wish to share their talent and dreams with their community.

Admission Requirements

- Bachelor degree

- At least 3 years of professional experience

- English proficiency

Upload the Required Documents

- Online application

- Letter of motivation

- University degrees and official transcripts

- CV

- Passport or ID card copy

- ID picture

- Proof of English proficiency (TOEFL, IELTS, Cambridge)

- 80€ application fees

- Letter of recommendation

Interview

- Face to face

- Phone interview

- Video call interview

Fees

Prices below are for information only and apply to the academic year 2024-25.

MBA program tuition: 41,900€.

In addition, all students pay the annual Student Association Fee of 190€, and the IUM for Life Fee of 650€ that gives lifelong access to Alumni services.

Contact-us

For further information

Call us:

+377 97 986 993

Send us an email:

MBA VOICES

Meet with Andrés Bonilla, an MBA student from Guatemala!

MBA VOICES

Meet with Karolina Paszkiewicz-Kolacz, an MBA student from Poland!